For something so important, it’s amazing how many women don’t know how their credit score is calculated. Your credit score could be the thing standing between you and that mortgage loan you need to buy your first home. It might tip the scale for or against you when you apply for your dream job. It might make the difference between paying 12% or 20% interest on your credit cards. In other words, your credit score matters. That’s why you need to understand how your credit score is tabulated and what you can do to improve it.

For something so important, it’s amazing how many women don’t know how their credit score is calculated. Your credit score could be the thing standing between you and that mortgage loan you need to buy your first home. It might tip the scale for or against you when you apply for your dream job. It might make the difference between paying 12% or 20% interest on your credit cards. In other words, your credit score matters. That’s why you need to understand how your credit score is tabulated and what you can do to improve it.

The Three Credit Reporting Agencies

It’d be nice if there was only a single agency that determined your credit score but that’s just not the case. Instead, three different agencies each separately compile a credit report on you and give you a score:

- Experian

- Transunion

- Equifax

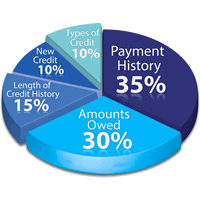

The scores may vary by a couple of points (sometimes more). Fortunately, all three agencies use the same criteria and weight that criteria in a similar way. Let’s look at the five things that will make or break your credit score*.

Payment History – 35%

The biggest factor in determining your credit score is whether or not you pay off your loans on time. That means paying your rent, making your auto and student loan payments, and paying at least the minimum balance on your credit cards.

The easiest way to tank your credit score is to miss a payment. As soon as a payment is 30 days late, a creditor can add a note to your credit report.

How to Improve – Just make all of your payments on time. If you can’t fully pay off your credit cards, at least make the minimum payment. If you can’t make a loan payment, don’t just ignore it. Call the creditor and try to negotiate. Many banks will allow customers to skip one payment a year or will allow you to make a partial payment.

Amounts Owed – 30%

This refers to how much credit you are using versus the amount of credit you have available (known as your “credit utilization ratio”). If you charge $500 on a credit card with a $1,000 line of credit, your credit utilization ratio is 50% for that card. The more debt you charge to your card, the more likely it will hurt your credit.

How to Improve – It’s always a good idea to keep balances low on your cards anyway, so our advice here is to try to pay down your credit cards as much as possible. (Paying interest = throwing away your money.) Ideally, you want to try to keep below 20% usage on each individual card and below 20% usage of all credit cards combined. One quick hack is to call your bank and ask for a higher line of credit. This will lower your credit utilization ratio… as long as you don’t increase your charges to fit your new allowance.

Length of Credit History – 15%

The minute you get approved for your first credit card or start making payments on your student loans, you’ll start building your credit history. The longer you hold credit, the higher your credit score will be.

How to Improve — It is as least worth considering getting credit as early as possible, as long as you can handle the responsibility. You can legally get a credit card at age 18 in the United States (though you’ll need to show proof of income).

New Credit – 10%

Credit scoring agencies will ding your credit score if you take out too much new credit in too short of a time. Be careful when applying for new credit cards, including store credit cards. Saving 10% on a purchase is nice, but is it worth lowering your credit score?

How to Improve – Sometimes life just happens and you need to take out multiple forms of credit in a short period of time. Be aware of this factor, and if you can, avoid opening a lot of lines of credit or taking out loans in the same year.

Credit Mix – 10%

You’d think that paying off your credit cards in full each month would be enough to give you a perfect credit score. Not so fast! Credit scoring agencies want you to show that you can handle holding different types of credit. This includes “revolving debt” (credit cards) and “installment loans” (mortgages, auto loans, student loans).

How to Improve – Younger folks often struggle with this one, since they may simply not have had the opportunity or need to take out a loan. One easy way to do this is to take out a loan for a new furniture purchase that you were already planning to buy, such as a mattress. Usually these loans include a special interest-free introductory period. Do you best to pay off the loan before the interest-free period runs out, and then you’ll get the credit boost without any extra cost!

It’s always a good idea to check your credit reports regularly to see how you are doing (and so that there aren’t any surprises when you sit down with your banker to discuss a mortgage loan). The U.S. government allows you to request your credit score for free once a year at https://www.annualcreditreport.com/index.action. Many banks also let their customers regularly check their credit scores for free.

Need help to improve your credit score? Consider creating a Money Club with your friends who want to improve their finances as well!

* Percentages taken from FICO Score formula — https://www.myfico.com/credit-education/whats-in-your-credit-score/

Keep Reading